Employee Business Expenses Deduction 2024 2025 – On Jan. 31, 2024, the House passed the Tax Relief for American Families and Workers Act of 2024 by a vote of 357-70. The vote reflects broad bipartisan support for the legislation. There is also broad . This structure is designed to match the asset’s business benefit to the years it was useful. However, by utilizing Section 179, businesses may immediately deduct equipment expenses in the same .

Employee Business Expenses Deduction 2024 2025

Source : m.facebook.comHow did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.orgHavig Tax & Consulting | Anoka MN

Source : www.facebook.comBusiness related Meals and Entertainment under Tax Reform Conway

Source : www.cdscpa.comBipartisan Tax Framework: Low Income, Wealthy Households Benefit

Source : www.taxpolicycenter.orgBarrett & Company PLLC, CPA’s | Camas WA

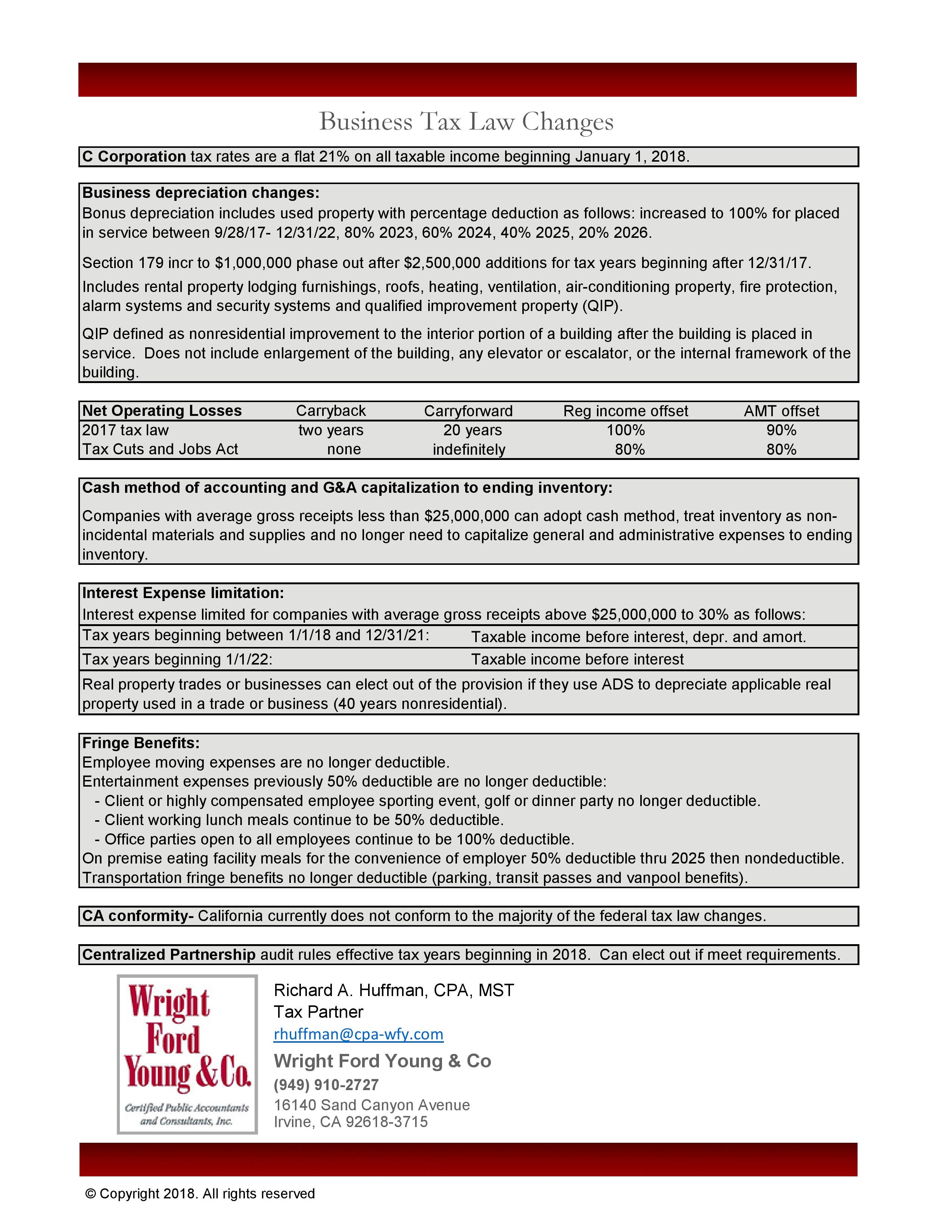

Source : www.facebook.comTax Law Changes Business Chart and Highlights | Wright Ford Young & Co

Source : www.cpa-wfy.comMehanna Advisors PLLC | Livonia MI

Source : m.facebook.comHow the Tax Cuts and Jobs Act Affects You

Source : www.thebalancemoney.comHouse passes bipartisan tax cut package | wfaa.com

Source : www.wfaa.comEmployee Business Expenses Deduction 2024 2025 Mark R. Stanhope CPA PC | Hudson MA: Potential Tax Relief By Kristina Drzal Houghton, CPA This article, written on Feb. 2, highlights the U.S. House of Representatives’ Jan. 31 passage of the Tax Relief for American Families […] . Increase in Interest Deductions Under current law, a taxpayer is generally able to deduct interest expenses attributable to its trade or business up to the sum placed in service during 2023, 2024, .

]]>

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)